Maybank Personal Loan Table, Your Path to Financial Flexibility

Discover the benefits of Maybank Personal Loans with our comprehensive guide. Explore Maybank Personal Loan tables, interest rates, and application details.

Life is filled with unexpected twists and turns, and sometimes, you might need some extra cash to navigate through them.

Whether it's a sudden emergency or an exciting opportunity, having a reliable source of funds can make all the difference.

That's where Maybank Personal Loans come into play. In

this article, we will delve into the world of Maybank Personal Loans, focusing

on the Maybank Personal Loan table, interest rates, and the application

process.

Maybank Personal Loan Essentials

Maybank offers personal loans designed to provide you with

the financial flexibility you need. Here are some key details about their

personal loans:

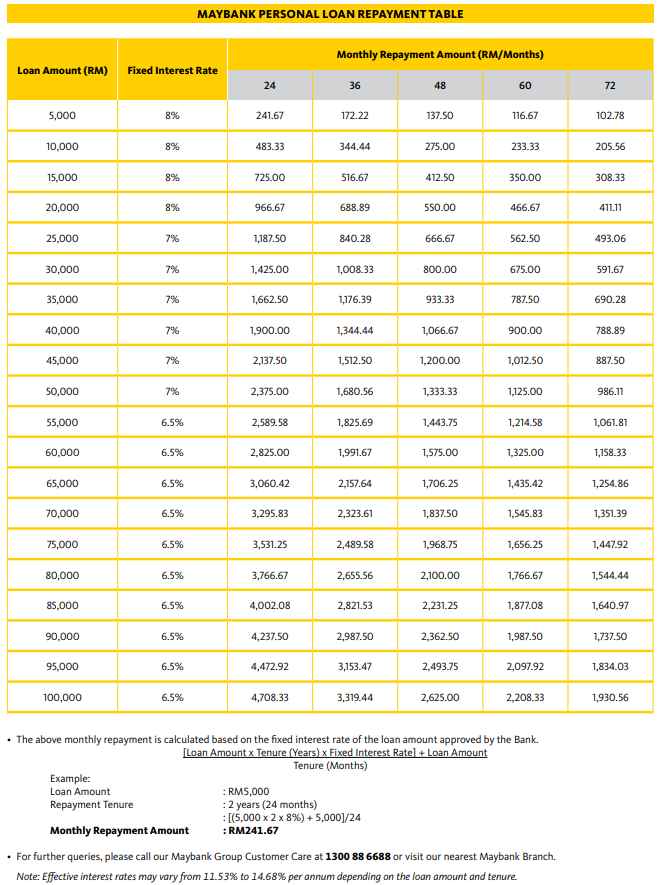

Loan Amount: Maybank offers personal loans with a minimum

amount of RM5,000 and a maximum amount of RM100,000.

Loan Tenure: You can choose a repayment period ranging from

a minimum of 2 years to a maximum of 6 years.

Fixed Interest Rates: Maybank offers competitive interest

rates on their personal loans:

- 8% p.a. for loan amounts ranging from RM5,000 to RM20,000.

- 7% p.a. for loan amounts from RM20,001 to RM50,000.

- 6.5% p.a. for loan amounts from RM50,001 to RM100,000.

Maybank Personal Loan Table

To understand how Maybank Personal Loans work, let's take a look at a sample of their monthly repayment table:

• The above monthly repayment is calculated based on the fixed interest rate of the loan amount approved by the Bank.

[Loan Amount x Tenure (Years) x Fixed Interest Rate] + Loan Amount

Tenure (Months)

Example:

Loan Amount : RM5,000

Repayment Tenure : 2 years (24 months)

: [(5,000 x 2 x 8%) + 5,000]/24

Monthly Repayment Amount : RM241.67

• For further queries, please call our Maybank Group Customer Care at 1300 88 6688 or visit our nearest Maybank Branch.

Note: Effective interest rates may vary from 11.53% to 14.68% per annum depending on the loan amount and tenure.

Why Choose Maybank Personal Loan?

Maybank Personal Loans offer several advantages, including:

- Easy Application: You can conveniently apply for a Maybank

Personal Loan through the MAE app or the Maybank2u website, without the need

for branch visits.

- Fast Approval: Maybank offers fast approval for customers

who have their salaries credited directly to their Maybank account.

- Low Monthly Repayments: With monthly repayments as low as

RM102.78 per month, Maybank Personal Loans are affordable and manageable.

- Optional Personal Care Insurance: You can opt for personal

care insurance with coverage of up to RM100,000 for added financial security.

- No Additional Fees: Maybank Personal Loans come with no stamping fees, processing fees, or the need for guarantors or collateral.

Required Documents

To apply for a Maybank Personal Loan, you need to meet the

following criteria and provide the necessary documents:

For Self-Employed Individuals:

- Valid Malaysia NRIC

- BE Form with an official Tax Receipt

- Latest 6 Months Bank Statement

- Copy of Business Registration

For Employees:

- Valid Malaysia NRIC

- Latest Salary Slip OR EA Form OR EPF Statement

- Applying for a Maybank Personal Loan

Ready to take the next step? You can apply for a Maybank Personal Loan now through the Maybank2u website or the MAE app.

Simply visit

the following link: Maybank Personal Loan Application.

If you have any questions or need further assistance, you

can contact Maybank Group Customer Care at 1300 88 6688 or visit your nearest

Maybank Branch.

Personal Loan Maybank , A Guide to Maybank's Offers

Conclusion

That's Maybank Personal Loans table. With competitive interest rates, flexible repayment options, and a straightforward application process, Maybank makes it easier for you to access the funds you require.

Consider Maybank Personal Loans as your trusted partner in achieving your financial goals, whether it's pursuing a dream vacation, covering unexpected medical expenses, or seizing exciting opportunities that come your way.

Apply today and take control of your financial future with Maybank Personal Loans.

Post a Comment for "Maybank Personal Loan Table, Your Path to Financial Flexibility"

Thank you for reading our article!

Feel free to share your opinions, experiences, or suggestions in the comment section below.